Fake account prevention starts here

What is a fake account?

Fake accounts are developed using a stolen or synthetic identity (a combination of fabricated and real identity data). The bad actor may log onto the account and commit fraud immediately or mimic legitimate user behavior for years to build credibility before conducting account-driven fraud, scams or large breakout schemes.

Why are fake accounts created?

Cybercriminals create fake accounts to spread malware, seek loans, execute money transfers, launder money, gain credit, purchase products and services, influence product reviews and spread misinformation.

Why do you need fake account prevention?

A fake account can leave significant destruction in its wake; from money laundering and credit breakout schemes to reputational damage and chargebacks that eat into profits.

By preventing these accounts from developing, organizations improve the trust and safety of their platform. Identifying stolen or fabricated information during the account building process prevents a fake account from being developed, safeguarding your organization, your legitimate customers and the payments ecosystem.

How fraudulent accounts happen

Fraudster creates account

Fraudsters develop accounts using stolen identity information or synthetic identities fabricated from a combination of real identity information.

Fraudster makes transactions

Fraudsters conduct transactions ranging from purchasing products or services to executing money transfers.

Fraudster logs onto account

Fraudster regularly log onto the account to mimic legitimate user behavior and build credibility. Once credibility is established, loans can be applied for and more accounts can be opened, depending on the strategy of the scammer.

The solution

After developing a fraudulent account, bad actors have a wealth of options at their fingertips. They could open new accounts to gain instant credit, launder money or generate value through promotional abuse, which can cause reputational damage to merchants’ platforms and result in chargebacks that eat into profits.

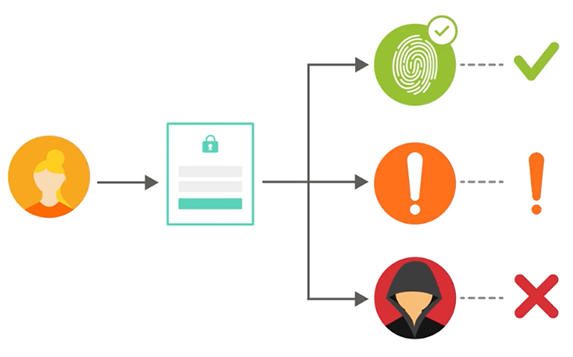

The Account Opening API exposes a set of proprietary network signals that provide insight on the legitimacy of input credentials to assess the risk of the customer onboarding in process.

Account Opening API

Onboard more customers with higher confidence and lower friction.

Identify potential bad actors

Identify stolen or fabricated information during the account building process to identify and prevent fraud.

Reduce friction for legitimate customers

Streamline your user registration process to validate legitimate customers and fast track their approval to onboard or transact.

Improve trust and safety within your platform

Prevent illegitimate access to your platform with a sound frictionless fraud prevention approach that accurately validates users.

Resources

Webinar

Mitigating fraud: A conversation on proactive account protection

Webinar

How you can stop account abuse with Sift and Mastercard

CONTACT AN EXPERt

See how Mastercard Identity can reduce fraud risk for your business.